Trading Strategies Guide

Why Trading Strategies are Important

A trading strategy provides a structured approach, helping you make consistent decisions based on predefined criteria rather than emotions.

Strategies include risk management techniques to protect your capital and minimize losses.

With a clear strategy, you can track and evaluate your performance, identifying areas for improvement.

A well-researched strategy can adapt to changing market conditions, keeping you ahead of the curve.

Key Components of a Trading Strategy

Understanding the market environment through fundamental, technical, and sentiment analysis.

Deciding when to enter and exit trades based on your analysis.

Implementing measures to control potential losses, such as stop-loss orders and position sizing.

Continuously reviewing and refining your strategy to enhance its effectiveness.

Forex Trading Strategies

Scalping

Scalping is a short-term trading strategy that aims to profit from small price movements within the Forex market. Traders who use this strategy, known as scalpers, execute dozens or even hundreds of trades in a single day. The goal is to capture small gains repeatedly, which can add up to significant profits over time.

- Time Frame: Typically 1-5 minute charts.

- Key Indicators: Moving Averages, Bollinger Bands, RSI.

- Example: A trader might enter a trade when the price crosses above a moving average and exit within a few minutes after a small price increase.

Swing Trading

Swing trading is a medium-term strategy where traders aim to capture gains from market swings over several days or weeks. This strategy involves holding positions longer than a day but shorter than trend trading.

- Time Frame: Daily to weekly charts.

- Key Indicators: Trend lines, MACD, Stochastic Oscillator.

- Example: A trader identifies a currency pair in an uptrend, buys the pair, and holds the position for several days until the price reaches a significant resistance level.

Day Trading

Day trading involves buying and selling currencies within the same trading day. Day traders do not hold positions overnight to avoid the risks associated with overnight market changes. This strategy requires a good understanding of market trends and quick decision-making.

- Time Frame: 15-minute to hourly charts.

- Key Indicators: Fibonacci retracements, MACD, Volume indicators.

- Example: A trader may buy a currency pair in the morning, take advantage of a price increase during the day, and sell before the market closes.

Position Trading

Position trading is a long-term strategy where traders hold positions for weeks, months, or even years. This strategy relies heavily on fundamental analysis to determine the long-term direction of the market.

- Time Frame: Weekly to monthly charts.

- Key Indicators: Economic data, geopolitical events, interest rate changes.

- Example: A trader buys a currency pair based on strong economic growth forecasts and holds the position for several months, benefiting from the currency’s appreciation.

CFD Trading Strategies

Hedging

Hedging is a strategy used to protect against potential losses by taking an opposite position in a related asset. This strategy is commonly used to mitigate risks in volatile markets.

- Key Instruments: Related CFDs, options.

- Example: A trader holding a long position in a stock CFD may take a short position in a market index CFD to offset potential losses if the stock price drops.

Speculative Trading

Speculative trading involves taking a position in an asset based on the expectation of future price movements. This strategy can be highly profitable but also carries significant risk.

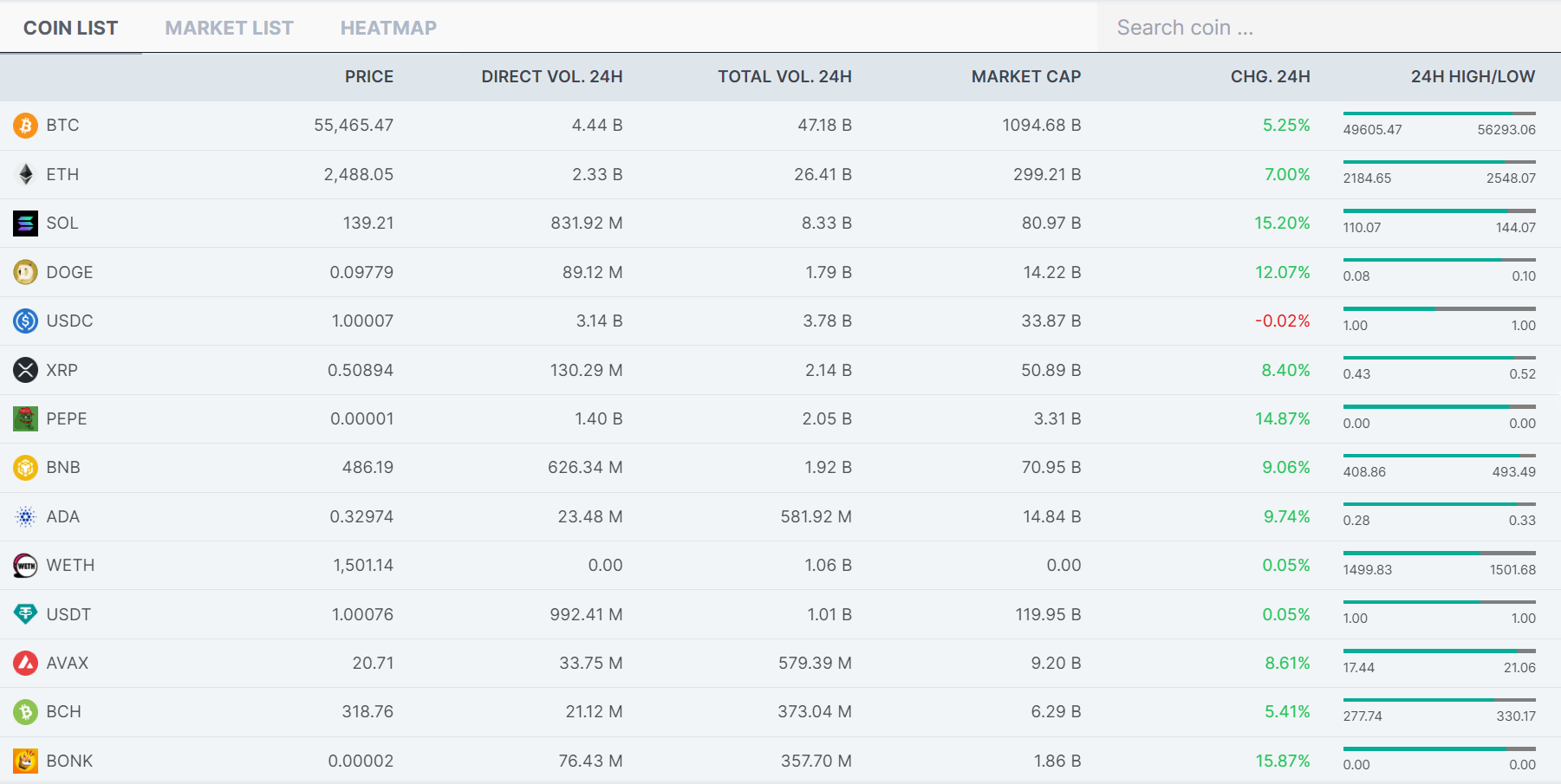

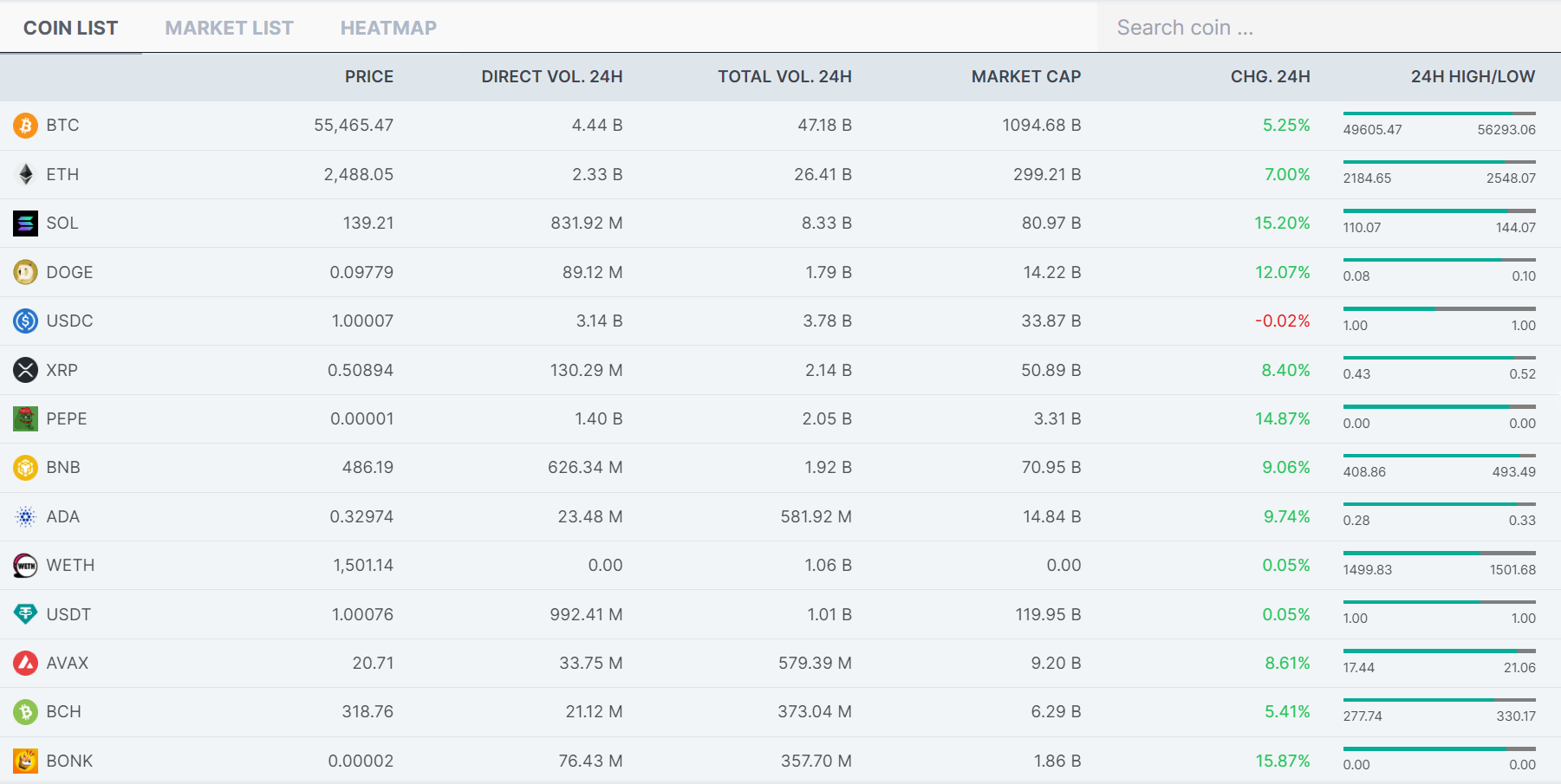

- Key Instruments: Various CFDs including commodities, indices, and cryptocurrencies.

- Example: A trader speculates that the price of gold will rise due to economic uncertainty. They buy gold CFDs and sell them after the price increases.

Arbitrage

Arbitrage involves taking advantage of price differences between markets or instruments. Traders buy an asset in one market and simultaneously sell it in another at a higher price, profiting from the price differential.

- Key Instruments: Different market CFDs.

- Example: A trader notices that a stock CFD is priced lower on one platform than on another. They buy the lower-priced CFD and sell the higher-priced CFD, profiting from the difference.

Your Journey to Financial Greatness Begins Here

Photonics platform equip you with everything you need to trade confidently. From beginner-friendly tools to expert insights, our platform is built to support your growth.

Leading the Way in Fintech Solutions

Setting Goals and Risk Tolerance

Before developing a trading strategy, it is crucial to define your trading goals and risk tolerance. Ask yourself what your profit targets are, how much you are willing to risk per trade, and what your overall risk tolerance is.

- What are your profit targets?

- How much are you willing to risk per trade?

- What is your overall risk tolerance?

Backtesting and Refining Your Strategy

Backtesting involves applying your trading strategy to historical market data to evaluate its effectiveness. This process helps identify potential weaknesses and areas for improvement.

- Tools: Trading platforms with backtesting capabilities, such as MetaTrader or TradingView.

- Process: Select a historical data set, apply your strategy, and analyze the results. Adjust your strategy based on findings and retest.

Implementing and Monitoring Your Strategy

Once you have a well-defined and tested strategy, implement it in a live trading environment. Continuously monitor and adjust your strategy based on market conditions and performance.

- Tools: Trading journals, performance analytics tools.

- Tips: Keep detailed records of your trades, regularly review your performance, and stay updated with market news and trends.