Introduction to Forex & CFD Trading

Leading the Way in Fintech Solutions

What is Forex Trading?

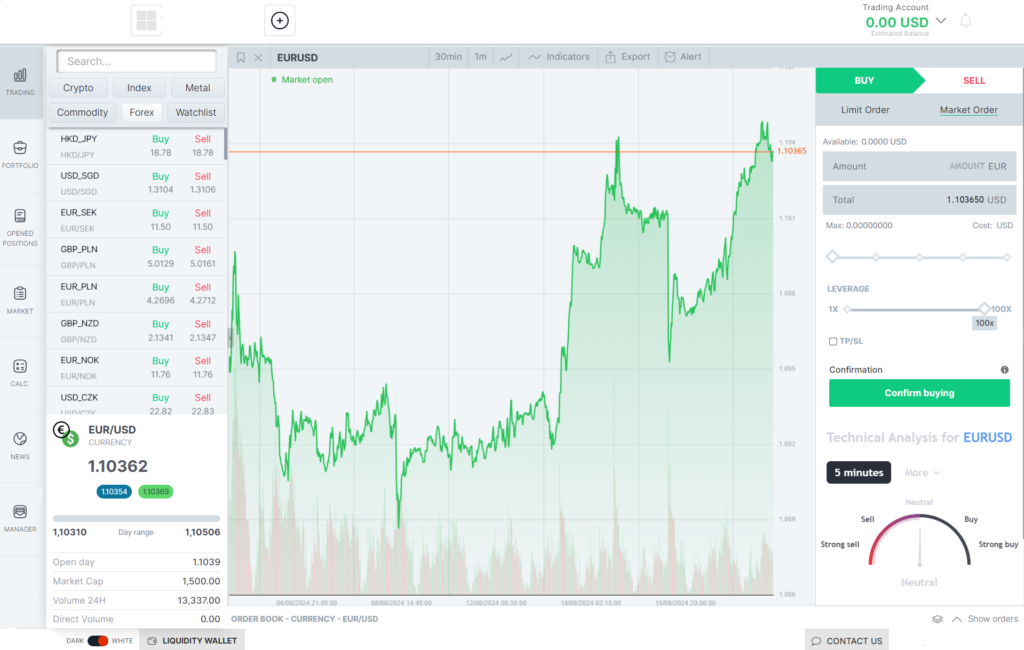

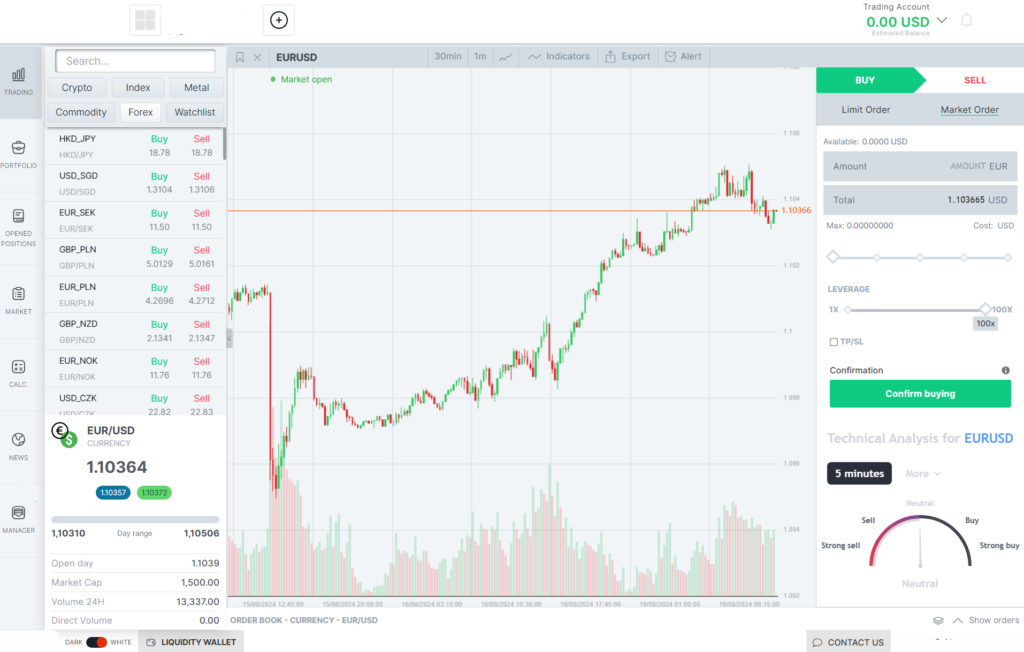

Forex trading, or foreign exchange trading, involves buying and selling currencies on the foreign exchange market with the aim of making a profit. The Forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion.

Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar), and the price of each currency pair fluctuates based on supply and demand factors, including economic indicators, geopolitical events, and market sentiment. Traders aim to profit from these fluctuations by buying low and selling high, or vice versa.

What is CFD Trading?

CFD stands for Contract for Difference. CFD trading allows traders to speculate on the price movements of various financial instruments, such as stocks, commodities, indices, and cryptocurrencies, without owning the underlying asset.

When trading CFDs, you enter into a contract with a broker to exchange the difference in the price of an asset from the time the contract is opened to the time it is closed. This means you can profit from both rising and falling markets, making CFDs a versatile trading option.

Leading the Way in Fintech Solutions

Your Journey to Financial Greatness Begins Here

Photonics platform equip you with everything you need to trade confidently. From beginner-friendly tools to expert insights, our platform is built to support your growth.

Key Terminology

The smallest price movement in a currency pair. For most currency pairs, a pip is equal to 0.0001.

Standardized quantities of currency or assets in trading. In Forex, a standard lot is 100,000 units of the base currency.

The use of borrowed funds to increase the potential return on investment. Leverage is expressed as a ratio, such as 1:100.

The amount of capital required to open and maintain a leveraged position. Margin is usually expressed as a percentage of the full position size.

The difference between the bid (buy) price and the ask (sell) price of a currency pair or CFD.

Common Questions

Common Questions About Forex & CFD Trading

Leverage allows you to control a larger position with a smaller amount of capital. For example, with 1:100 leverage, you can control $10,000 with just $100. While leverage can amplify profits, it also increases the potential for losses. It's crucial to use leverage wisely and understand the risks involved.

Velit sociosqu purus enim pharetra sed sem at iaculis. Felis ridiculus adipiscing dignissim eros pellentesque mus vitae litora. Felis nullam tortor phasellus viverra ut arcu. Euismod magnis ante convallis vulputate odio augue sit pretium dapibus.